20 30 50 Savings Calculator

Free 20 30 50 Savings Calculator online.

Explanation

20 30 50 Savings Calculator: Your first step towards a stable financial future!

Do you dream of achieving your financial goals and financial stability?

Do you aim to build wealth to help achieve your dreams and ambitions?

Are you looking for an easy-to-use tool to help you save effectively?

Here is the 20 30 50 Savings Calculator, your ideal companion in your savings journey!

What is the 20 30 50 Savings Calculator?

It is an innovative tool designed to help you:

* Set your financial goals: Define short-term and long-term financial goals such as buying a house, a car, traveling, or retirement.

* Create a customized savings plan: The 20 30 50 Savings Calculator will help you create a savings plan tailored to your needs and capabilities.

* Calculate how much you need to save monthly: The tool will help you calculate the monthly amount you need to save to achieve your financial goals.

What are the benefits of using the 20 30 50 Savings Calculator?

* Achieve financial stability: The calculator helps achieve financial stability and fulfill your dreams and ambitions.

* Avoid debt: The tool helps avoid debt by promoting good saving habits.

* Feel secure and comfortable: The calculator helps build wealth to face future financial challenges.

* Improve your quality of life: The tool improves your quality of life by achieving your financial goals.

* Inspire others: The calculator inspires others by sharing your saving success story.

Additional Tips:

* Start early: The earlier you start saving, the more wealth you build.

* Save regularly: Allocate a fixed amount from your salary each month.

* Invest your savings: Grow your savings by investing in safe and reliable investment tools.

* Live simply: Reduce unnecessary expenses and focus on saving.

* Be patient: Achieving financial goals requires patience and persistence.

With the 20 30 50 Savings Calculator, your saving journey will be enjoyable and rewarding!

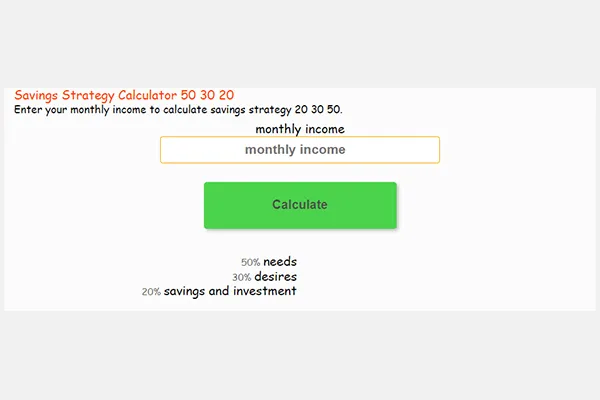

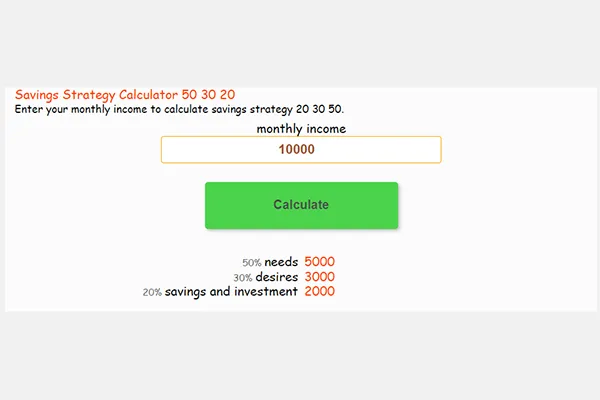

Tool to calculate savings from monthly income using the 20 30 50 rule, where 50% of income is for needs like food and essentials, 30% for wants like outings and hobbies, and 20% for savings and investments.

How to calculate savings online?

Step1 :

To calculate savings using the 30 40 50 rule, you need to specify your monthly income.

Step2 :

After specifying your monthly income, enter the data into the calculator in the income field.

Step3 :

Click Calculate to get your savings information for your monthly income categorized into needs, wants, and savings.

Benefits of the 20 30 50 Savings Calculator

Achieve financial stability: The 20 30 50 Savings Calculator helps achieve financial stability and fulfill your dreams and ambitions.

Avoid debt: The tool helps avoid debt by promoting good saving habits.

Feel secure and comfortable: The tool helps build wealth to face future financial challenges.

Improve your quality of life: The tool improves your quality of life by achieving your financial goals.

Inspire others: The tool inspires others by sharing your saving success story.

20 30 50 Savings Rule

The 20-30-50 rule is a simple and effective tool for managing money and achieving financial goals.

How does the 20-30-50 rule work?

The rule divides your monthly income into three main categories:

* 20% for needs: Includes essential expenses such as rent or mortgage, food, transportation, and bills.

* 30% for wants: Includes non-essential expenses such as entertainment, dining out, travel, and shopping.

* 50% for future financial needs: Includes savings, investments, and debt repayment.

Benefits of the 20-30-50 rule:

* Simplicity: Easy to remember and apply to your budget.

* Effectiveness: Helps achieve short-term and long-term financial goals.

* Financial balance: Enhances your sense of control over your money and prevents overspending.

* Financial security: Ensures you have a financial cushion for emergencies.

Tips for applying the 20-30-50 rule:

* Assess your income and expenses: Determine your net monthly income and list all your expenses.

* Categorize expenses: Classify your expenses into categories (needs, wants, future financial needs).

* Adjust your budget: Compare your expenses with the rule's percentages and make necessary adjustments.

* Strict adherence: Follow the rule closely and avoid spending beyond its limits.

* Regular review: Periodically review your budget and make adjustments as needed.

Note: Ideal percentages may vary based on personal circumstances and needs.

Looking for more tips to improve your budget and achieve your financial goals?

* Set financial goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals.

* Create a financial plan: Develop a detailed plan to achieve your financial goals, including saving and investment plans.

* Explore additional income sources: Look for ways to increase your income, such as freelancing or investing in side projects.

* Reduce debt: Focus on paying off high-interest debt first.

* Seek professional help: Consider consulting a financial advisor if you need assistance managing your money.